- Depreciation calculation in accordance with the New Companies Act of 2013.

- Depreciation aligned with the provisions of the Income Tax Act of 1961.

- Multi-shift depreciation capability.

- IFRS compliance with support for US-based MACRS depreciation.

- Ability to create additional user-defined depreciation books.

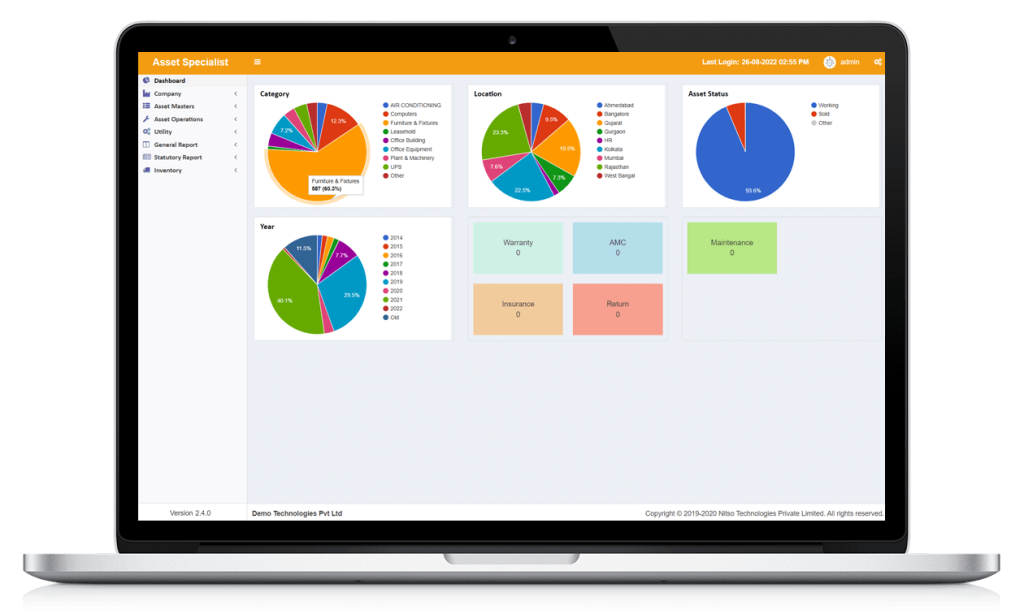

- Custom report creation using the Report Builder feature.

- Asset AMC/Warranty/Insurance tracking with the ability to attach scan documents.

- Attachment of asset images, purchase orders, vendor invoices, and other documents to assets.

- Sale/Discard of assets with an approval process, enabling monitoring of any profit or loss.

- User-defined email alerts for reminders on pending activities.

- Complete web-based solution with on-cloud support.

- Support multi-location operations.

- Asset tagging options include Barcode/QR Codes/RFID/GPS.

- Rapid deployment with minimal associated costs.